Property Tax Rate In Williamsburg Va . find out how much you pay in property taxes in virginia based on your home value and location. Virginia individual income tax information. find information about real estate assessment, tax deferrals, exemptions, and income and expense forms for the city of williamsburg. find information about property assessments, taxes, and exemptions for businesses and residents in james city county. Room, lodging, and meal tax information. the median property tax (also known as real estate tax) in williamsburg city is $1,856.00 per year, based on a median home value of. Find out the tax rate, assessment and. Compare property tax rates across counties and cities and learn how to. learn how real estate taxes are billed, calculated and paid in james city county, va. calendar year 2024 assessment values used to calculate fiscal year 2025 real estate tax bills.

from www.homeadvisor.com

find information about real estate assessment, tax deferrals, exemptions, and income and expense forms for the city of williamsburg. Virginia individual income tax information. the median property tax (also known as real estate tax) in williamsburg city is $1,856.00 per year, based on a median home value of. Find out the tax rate, assessment and. Room, lodging, and meal tax information. find out how much you pay in property taxes in virginia based on your home value and location. find information about property assessments, taxes, and exemptions for businesses and residents in james city county. learn how real estate taxes are billed, calculated and paid in james city county, va. calendar year 2024 assessment values used to calculate fiscal year 2025 real estate tax bills. Compare property tax rates across counties and cities and learn how to.

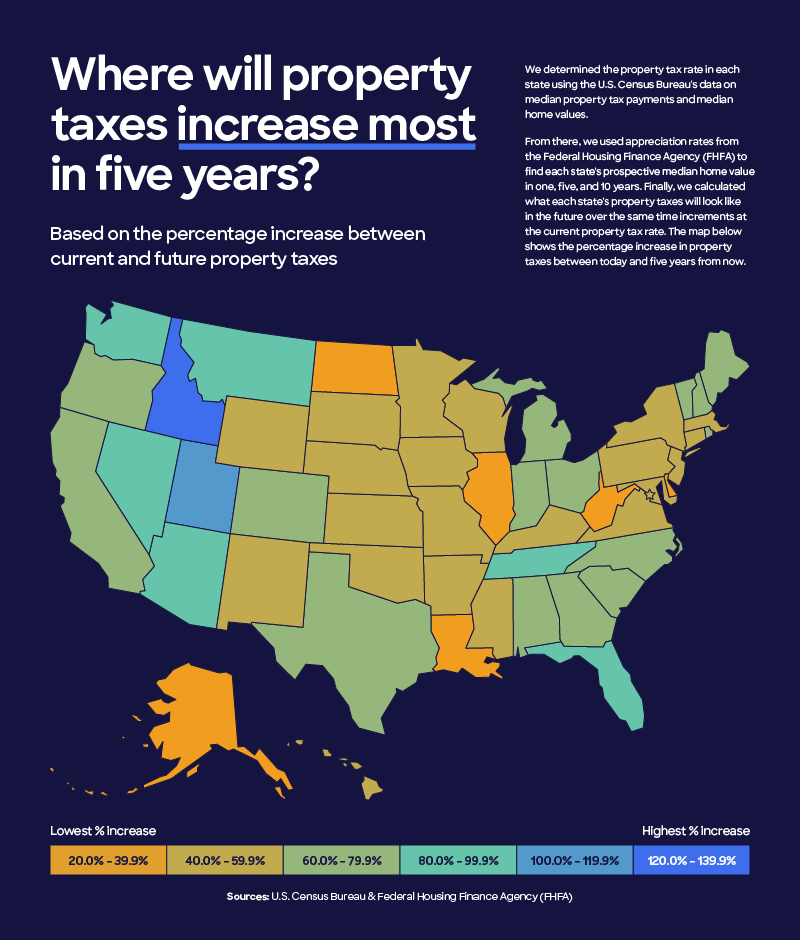

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor

Property Tax Rate In Williamsburg Va calendar year 2024 assessment values used to calculate fiscal year 2025 real estate tax bills. learn how real estate taxes are billed, calculated and paid in james city county, va. find out how much you pay in property taxes in virginia based on your home value and location. find information about property assessments, taxes, and exemptions for businesses and residents in james city county. Room, lodging, and meal tax information. Compare property tax rates across counties and cities and learn how to. Find out the tax rate, assessment and. the median property tax (also known as real estate tax) in williamsburg city is $1,856.00 per year, based on a median home value of. Virginia individual income tax information. calendar year 2024 assessment values used to calculate fiscal year 2025 real estate tax bills. find information about real estate assessment, tax deferrals, exemptions, and income and expense forms for the city of williamsburg.

From williamsburgiowa.gov

FY23 Proposed Property Tax Levy Hearing Notice Williamsburg, IA Property Tax Rate In Williamsburg Va find information about real estate assessment, tax deferrals, exemptions, and income and expense forms for the city of williamsburg. find information about property assessments, taxes, and exemptions for businesses and residents in james city county. learn how real estate taxes are billed, calculated and paid in james city county, va. Compare property tax rates across counties and. Property Tax Rate In Williamsburg Va.

From www.dailypress.com

James City, Williamsburg budget proposals call for no change to real Property Tax Rate In Williamsburg Va Room, lodging, and meal tax information. the median property tax (also known as real estate tax) in williamsburg city is $1,856.00 per year, based on a median home value of. Virginia individual income tax information. find out how much you pay in property taxes in virginia based on your home value and location. calendar year 2024 assessment. Property Tax Rate In Williamsburg Va.

From ceglmbky.blob.core.windows.net

Personal Property Tax Williamsburg Va at Warren Wilson blog Property Tax Rate In Williamsburg Va find information about real estate assessment, tax deferrals, exemptions, and income and expense forms for the city of williamsburg. Find out the tax rate, assessment and. Compare property tax rates across counties and cities and learn how to. calendar year 2024 assessment values used to calculate fiscal year 2025 real estate tax bills. find information about property. Property Tax Rate In Williamsburg Va.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Property Tax Rate In Williamsburg Va find information about real estate assessment, tax deferrals, exemptions, and income and expense forms for the city of williamsburg. find information about property assessments, taxes, and exemptions for businesses and residents in james city county. the median property tax (also known as real estate tax) in williamsburg city is $1,856.00 per year, based on a median home. Property Tax Rate In Williamsburg Va.

From www.redfin.com

2908 Richard Grv N, Williamsburg, VA 23185 MLS 10491134 Redfin Property Tax Rate In Williamsburg Va find information about real estate assessment, tax deferrals, exemptions, and income and expense forms for the city of williamsburg. Find out the tax rate, assessment and. find information about property assessments, taxes, and exemptions for businesses and residents in james city county. the median property tax (also known as real estate tax) in williamsburg city is $1,856.00. Property Tax Rate In Williamsburg Va.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Property Tax Rate In Williamsburg Va Room, lodging, and meal tax information. Virginia individual income tax information. Compare property tax rates across counties and cities and learn how to. calendar year 2024 assessment values used to calculate fiscal year 2025 real estate tax bills. find information about real estate assessment, tax deferrals, exemptions, and income and expense forms for the city of williamsburg. . Property Tax Rate In Williamsburg Va.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Property Tax Rate In Williamsburg Va the median property tax (also known as real estate tax) in williamsburg city is $1,856.00 per year, based on a median home value of. find information about property assessments, taxes, and exemptions for businesses and residents in james city county. Compare property tax rates across counties and cities and learn how to. calendar year 2024 assessment values. Property Tax Rate In Williamsburg Va.

From realestatestore.me

2018 Property Taxes The Real Estate Store Property Tax Rate In Williamsburg Va calendar year 2024 assessment values used to calculate fiscal year 2025 real estate tax bills. Virginia individual income tax information. find out how much you pay in property taxes in virginia based on your home value and location. find information about real estate assessment, tax deferrals, exemptions, and income and expense forms for the city of williamsburg.. Property Tax Rate In Williamsburg Va.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Property Tax Rate In Williamsburg Va Virginia individual income tax information. Compare property tax rates across counties and cities and learn how to. Find out the tax rate, assessment and. learn how real estate taxes are billed, calculated and paid in james city county, va. find out how much you pay in property taxes in virginia based on your home value and location. . Property Tax Rate In Williamsburg Va.

From www.armstrongeconomics.com

US Property Tax Comparison By State Armstrong Economics Property Tax Rate In Williamsburg Va calendar year 2024 assessment values used to calculate fiscal year 2025 real estate tax bills. Room, lodging, and meal tax information. find information about property assessments, taxes, and exemptions for businesses and residents in james city county. find out how much you pay in property taxes in virginia based on your home value and location. learn. Property Tax Rate In Williamsburg Va.

From www.ezhomesearch.com

EZ Home Search Guide to Virginia Property Taxes Property Tax Rate In Williamsburg Va Virginia individual income tax information. Room, lodging, and meal tax information. Compare property tax rates across counties and cities and learn how to. find information about real estate assessment, tax deferrals, exemptions, and income and expense forms for the city of williamsburg. learn how real estate taxes are billed, calculated and paid in james city county, va. . Property Tax Rate In Williamsburg Va.

From moco360.media

How would MoCo’s proposed property tax hike stack up against other Property Tax Rate In Williamsburg Va Room, lodging, and meal tax information. Find out the tax rate, assessment and. Compare property tax rates across counties and cities and learn how to. calendar year 2024 assessment values used to calculate fiscal year 2025 real estate tax bills. learn how real estate taxes are billed, calculated and paid in james city county, va. find information. Property Tax Rate In Williamsburg Va.

From www.southcarolinalanddeals.com

2.2 Acres RAW LAND on Wallace Rd Tax Map 45111109 (Williamsburg Property Tax Rate In Williamsburg Va Room, lodging, and meal tax information. the median property tax (also known as real estate tax) in williamsburg city is $1,856.00 per year, based on a median home value of. Compare property tax rates across counties and cities and learn how to. Virginia individual income tax information. calendar year 2024 assessment values used to calculate fiscal year 2025. Property Tax Rate In Williamsburg Va.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics Property Tax Rate In Williamsburg Va find information about real estate assessment, tax deferrals, exemptions, and income and expense forms for the city of williamsburg. Room, lodging, and meal tax information. find information about property assessments, taxes, and exemptions for businesses and residents in james city county. Virginia individual income tax information. Find out the tax rate, assessment and. calendar year 2024 assessment. Property Tax Rate In Williamsburg Va.

From www.realtor.com

Williamsburg, VA Real Estate Williamsburg Homes for Sale Property Tax Rate In Williamsburg Va find information about property assessments, taxes, and exemptions for businesses and residents in james city county. Room, lodging, and meal tax information. Compare property tax rates across counties and cities and learn how to. learn how real estate taxes are billed, calculated and paid in james city county, va. find out how much you pay in property. Property Tax Rate In Williamsburg Va.

From www.yoursurvivalguy.com

The Highest Property Taxes in America Your Survival Guy Property Tax Rate In Williamsburg Va calendar year 2024 assessment values used to calculate fiscal year 2025 real estate tax bills. find out how much you pay in property taxes in virginia based on your home value and location. learn how real estate taxes are billed, calculated and paid in james city county, va. Compare property tax rates across counties and cities and. Property Tax Rate In Williamsburg Va.

From www.fraxtor.com

How would the revised property tax rates affect the housing market Property Tax Rate In Williamsburg Va Find out the tax rate, assessment and. learn how real estate taxes are billed, calculated and paid in james city county, va. Virginia individual income tax information. Room, lodging, and meal tax information. find out how much you pay in property taxes in virginia based on your home value and location. Compare property tax rates across counties and. Property Tax Rate In Williamsburg Va.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Property Tax Rate In Williamsburg Va learn how real estate taxes are billed, calculated and paid in james city county, va. Compare property tax rates across counties and cities and learn how to. Find out the tax rate, assessment and. Virginia individual income tax information. the median property tax (also known as real estate tax) in williamsburg city is $1,856.00 per year, based on. Property Tax Rate In Williamsburg Va.